There was just too much going on in the IMF report I blogged about yesterday to cover it all. However, one of the most interesting paragraphs is the following:

'The third advantage of the Chicago Plan is a dramatic reduction of (net) government debt. The overall outstanding liabilities of today’s U.S. financial system, including the shadow banking system, are far larger than currently outstanding U.S. Treasury liabilities. Because under the Chicago Plan banks have to borrow reserves from the treasury to fully back these large liabilities, the government acquires a very large asset vis-à-vis banks, and government debt net of this asset becomes highly negative. Governments could leave the separate gross positions outstanding, or they could buy back government bonds from banks against the cancellation of treasury credit. Fisher had the second option in mind, based on the situation of the 1930s, when banks held the major portion of outstanding government debt. But today most U.S. government debt is held outside U.S. banks, so that the first option is the more relevant one. The effect on net debt is of course the same, it drops dramatically.'

The report also suggested a buy-back of private debt, the other side of the debt coin that is holding back the global economy.

What is the explanation for this extraordinary change of heart, if not yet of policy? Could it be that the US acknowledges that its debt, both public and private, is simply unpayable? However great the temptation to return to the lure of further borrowing, eventually states as well as individuals must adjut that they are bankrupt. But the US has grown rich on producing debt that has been bought by other countries, and those at the top of the pile have grown the richest, fastest. There must surely be a price to be paid rather than letting the financiers and those who have gambled with them slope off to their mansions in the Hamptons.

In an earlier paper I suggested that a default of the largest sovereign debtors was inevitable. I proposed that the price the world might extract would be to implement a new global currency regime that uses carbon as backing for the global trading currency. This would allow a fresh start but would limit the consumption of all countries to a level that is environmentally sustainable and will allow us to avoid frying the planet.

Tweet

All other green campaigns become futile without tackling the economic system and its ideological defenders. Economics is only dismal because there are not enough of us making it our own. Read on and become empowered!

Showing posts with label ebcu. Show all posts

Showing posts with label ebcu. Show all posts

23 October 2012

4 November 2011

Why is the Euro so Strong?

With chaos in the negotiations with Greece, rumours of potential bankruptcy in Italy, and real concerns about the economies of Portugal and Spain, you would expect the currency that binds all these countries together to be falling through the floor. The graphic indicates that, over the past calamitous year, the range of movement has been between 1.48 and 1.28, and that at the value of the euro is hardly any lower than it was a year ago.

With chaos in the negotiations with Greece, rumours of potential bankruptcy in Italy, and real concerns about the economies of Portugal and Spain, you would expect the currency that binds all these countries together to be falling through the floor. The graphic indicates that, over the past calamitous year, the range of movement has been between 1.48 and 1.28, and that at the value of the euro is hardly any lower than it was a year ago.I was stung by a comment on one of my blogs from last week, complaining that I was being incomprehensible and jargonistic, so here I am going to explain simply why I think this is the case. This comes down to a discussion about what I have been calling for several years the 'currency wars'. When faced with hard times countries seek to return to growth and one means of doing this is to increase the volume of exports. Having a weaker currency makes your exports cheaper to the countries who buy them. So countries have been deliberately reducing the value of their currencies.

There are various ways of doing this. Some commentators claim that the US policy of quantitative easing is deliberately designed to achieve this end. Certainly, putting a lot of extra currency into circulation should reduce the inherent value of that currency. A more obvious way is just to lower your interest rates: since interest rates are effectively the price of money, this is an automatic means of making your money cheaper and causing its value relative to other currencies to fall.

To keep some sort of idea of the relative value of different currencies we need a standard, sometimes called the numeraire. In the 19th century gold was used as this standard, but this had all sorts of distorting effects on economic activity - primarily the fact that you couldn't increase economic activity unless bare-chested chaps deep in the bowels of the earth were digging up enough of a golden metal, which was frankly completely irrational, although emotionally appealing.

At Bretton Woods, the conference where the victors in the Second World War negotiated the shape of the world economy in the decades to follow, it was agreed, reluctanctly, to allow the dollar to take this role and to become the world's reserve currency. The consequences were hugely beneficial to the US in terms of imports, but ultimately destroyed its productive economy.

As the power of the dollar wanes, the other currencies that traders consider strong enough to take the role of a global reserve currency - the Japanese Yen, the Swiss Franc, the euro, and even sterling itself - have all become more attractive. This explains why we are not facing the speculative attacks that Greece is, not the performance of George Osborne at international conferences. As each currency becomes attractive to traders seeking a safe haven, the authorities that control its value seek to undermine it, since they do not want to suffer the export problems that result from having a highly valued currency.

In this form of reserve currency, the euro is still an attractive option and its interest rate of 1.5% now seems high by comparison with just 0.5% in the UK and 0.25% in the US. In addition, its competitors in terms of being the currency of last resort would resist its value falling too far, since that would require them to take more of the strain. This has led to the currency wars, which are a form of trade war in disguise. Because such wars cause international tensions, a solution that involves the creation of a neutralreserve currency, run for the benefit of the world's people and not an individual state, has long been my preferred option.

. Tweet

7 September 2011

Neutral Switzerland Joins Currency Wars

There has been discussion in earlier posts on this blog about the role of reserve currencies and of the developing conflict over the value of different national currencies. Switzerland's currency, the Swiss Franc, plays a unique role in the global economy. It is the store-of-value currency of choice, rather than the medium-of-exchange currency of choice, which until very recently has been the dollar.

There has been discussion in earlier posts on this blog about the role of reserve currencies and of the developing conflict over the value of different national currencies. Switzerland's currency, the Swiss Franc, plays a unique role in the global economy. It is the store-of-value currency of choice, rather than the medium-of-exchange currency of choice, which until very recently has been the dollar.So what does it mean that Swiss francs will now be sold at a price determined by the Swiss central bank? It means that for the first time in around 30 years one of the world's leading reserve currencies is not finding its price according to market forces. Those market forces were driving up the value of Switzerland's national currency to such a degree that it was find it impossible to be competitive. It's central bank is now maintaining a lower level.

Two points are of interest to observers of the global economy. First, this is a historic moment. Those of us who have been ridiculed for suggesting that a system of freely floating exchange rates removes democratic control over national economies, encourages conflict between nations, and facilitates harmful speculation have been vindicated. In currency terms, one of the most powerful players in the global economy now agrees with us.

But more important is the clear need to separate the role a national currency plays in facilitating economic transactions within a nation-state from that of enabling trade between nations. The hegemony of the dollar since 1945 as the global medium of exchange has enabled the obscene consumption of that country's citizens and facilitated its acquisition of military firepower that has allowed it to reign supreme. It has also destroyed that country's domestic productive economy. Switzerland fears similar consequences. It has benefited hugely from being the safe-haven currency, but in this era of instability is paying the price.

The logical answer is clear, and has been a key demand of posts on this blog since its inception. What we need is a global trading currency that is not linked to any national economy. Without this, the currency wars can only grow more intense, and, as we saw in the 1930s, currency wars can lead to wars that are even more destructive.

. Tweet

Labels:

bancor,

currency wars,

ebcu,

reserve currency,

Swiss franc

11 November 2010

Diverting the Currency Wars

Robert Skidelsky joins the debate about the need for a neutral global trading currency, but this time in the Financial Times which is also available at his personal website. This is the Green Party's policy and was proposed by this blog for the last G20. Skidelsky, being an unreconstructed Keynsian, has not included the planetary limit in his thinking; the EBCU proposal would do this. China will be arguing for a neutral currency, issued by the World Bank, as it has been doing for some time. We should put our energies behind this call, but with the additional twist of a currency that keeps trade and production within environmental limits, as well as bringing balance and equity.

. Tweet

. Tweet

22 May 2009

One Day All Money Will be Created this Way

In an earlier post I questioned what might be the limitation on the policy agreement between the Bank of England and the UK Debt Management Agency that one can create money from thin air which is then used to buy UK national debt. For a while I have been calling for a transparent process to reduce the the level of this debt from the unpayable quantities announced in the Budget. I now realise that there is a very murky version of such a policy already in operation.

So what prevents the UK government from eliminating the whole of our national debt in this way, by creating money from thin air, or what Mary Mellor calls 'fresh air money'? The traditional response would have been 'Inflation' - because 'once the economy picks up again' there will be too much money in the system. The created money is buying debt that was generated to pay the debts of the banks. So the fact that the Bank of England is countenancing this suggests that nobody expects the 'assets' that we have bought from those banks to ever be worth anything. They are not a future inflation risk because they are as worthless as we always expected - debt and definitely not assets.

Such a policy of creating money to repay our own debt cannot possibly make the UK less solvent, since it is removing the quantity of debt and thus improving out balance-sheet. So why is Standard & Poors threating to downgrade our credit-worthiness as a nation from three stars to two? Leaving aside the question of how much weight we should attach to the views of these agencies that were quite happy with the banks' utterly worthless assets, why should they be making this announcement now?

It seems that there is a struggle going on at the heart of capitalism and this is a shot across the bows of governments that are reneging on the deal they made with corporate investors and the sovereign wealth funds controlled by national governments - the two groups who buy UK national debt.

How does it affect the corporate bond-holders if much of our national debt is simply eliminated by sleight-of-hand? One would have thought that it would have increased their ability to extract work from the labourers of Britain to pay the interest on their gilts, since they are now competing with fewer holders of gilts for their share of this value.

As for national governments holding sterling as reserves, they may become uneasy (queasy?) about the value of these assets, since the QE buy-back policy suggests an inability to support the levels of debt that have been taken on by the UK government. But again, the reality is that as the level of debt is managed down, the ability of UK plc to make good on what remains is increased.

The real issue is a political one. Money is being created from thin air to enable banks that extracted huge amounts of value during the asset bubble to carry on functioning - to maintain themselves as ongoing concerns that can thus continue to hold these 'assets'. What must really frighten the board of Global Capital Inc. is the thought that we, the revolting peasants of these islands, might demand that money is created in a similar way to pay for schools, hospitals and the others services that are so under-financed.

So the downgrading of national debt is a shot across the bows of a government that has increased investment in the public sector in recent years - the lastest move by the privateers to establish their power over our national economic life following a time when the government was forced to introduce a de facto socialist regime. It reinforces that massive transfer of value to the rich that the bank bailout represents, and reinforces the rules of the capitalist game that those who earn must work for their living, while those who own need not. Creating money directly is a head-on challenge to these rules and this is why it must be undermined. Tweet

Labels:

ebcu,

gilts,

national debt,

quantitative easing,

reserve currencies

1 April 2009

G20-20: No Vision

Yes, I know it's tempting to smash things up. I can't remember the last time I felt so frustrated as when I watched that glass window go at the RBS building and realised I could have been there if I hadn't been in an Economics and Accounting management meeting. Even the thought of being hemmed in by thousands of coppers without access to a toilet failed to persuade me I'd made the right decision to go to work today.

It is not difficult to say where the G20 should be going - the media are choosing to hear from the same old men with blue eyes and pale faces who caused the problem. The sense appears to be coming from people dressed up as apocalyptic horsemen and clowns. I am sorry to say that the Green Party has taken to wearing suits (and having a leader) in the mistaken belief that this will ensure we are given more serious attention by the media and political classes. If only it were so simple I might wear a suit myself.

But lest you despair, I will share with you the radical, visionary and just policy that was passed a fortnight ago at our still fully democratic party conference in Blackpool:

International finance

EC960 The present international financial system provides disproportionate benefits to banks, trans-national corporations and currency speculators. It must be replaced by a system in which money returns to its proper role as a medium of exchange, not a commodity in its own right. This requires international negotiation. The result could be a reformed World Bank and International Monetary Fund at the centre of a global economic system with commercial institutions playing a much diminished role.

EC961 The tripartite global system regulating international finance should be replaced by three new bodies: an International Reserve Bank to administer the neutral international exchange currency (EBCU); an International Clearing Union to oversee goods and carbon trading; a General Agreement on Sustainable Trade.

EC962 All countries belonging to the tripartite system should make their currencies convertible but according to internationally negotiated and fixed exchange rates. Domestically countries would be expected to administer exchange controls.

EC963 The global trading system would aim to achieve balance trade between countries; those which operated extended surpluses or deficits would be fined.

EC964 The US dollar should no longer be accepted as equivalent to gold in international transactions and other national or supra‐national (i.e. the euro) currencies should no longer be used as international reserve currencies.

EC965 Their role should be taken on by a neutral international currency ‐ the EBCU ‐ linked to the right to produce carbon dioxide. Tweet

16 October 2008

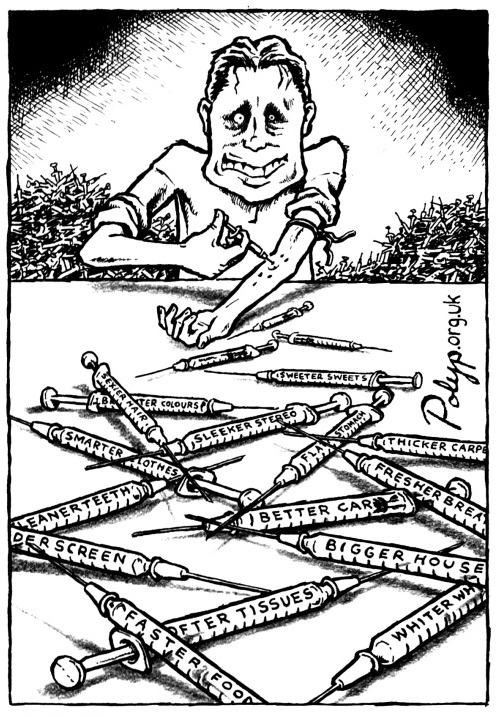

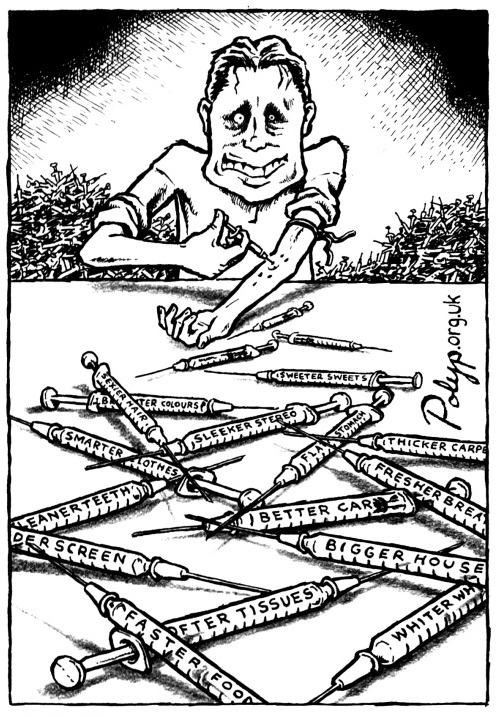

Hero or Heroin

I'm sure Gordon Brown was secretly delighted to have been compared with Flash Gordon at a recent press conference. Given his recent shady dealings with the bankster fraternity I would have thought Flash Harry was more appropriate. What would the flaming red Gordon of his student days have made of this man who is putting the poor of this country in debt to prop up a failing capitalist system?

But is it the right thing to do, to fuel capitalism's addiction to money? Isn't Gordon rather acting as a drug dealer, providing more of just what is worst for the global economy, bloated with years of excess and destroying the body it depends on?

But is it the right thing to do, to fuel capitalism's addiction to money? Isn't Gordon rather acting as a drug dealer, providing more of just what is worst for the global economy, bloated with years of excess and destroying the body it depends on?

If you will indulge my extended metaphor for a while longer, perhaps we could explore what mechanisms we might pursue to tackle the addiction, to move the economy away from its moneylust and towards a balanced steady state. What would be the methadone that we could introduce as a substitute during the transition?

Gordon is calling for a summit to debate a new financial architecture. Part of that might be Richard Douthwaite's Ebcu or environment-backed currency unit. This is a neutral currency created by agreement between the world's nations and under their control. It could contribute to a global economy where the economic power of countries was more equal; in a world dominated by the dollar this can never be the case.

But more importantly, because the ebcu is linked to emissions of carbon dioxide, it operates like a carbon standard, linking economic activity to the ability of the planet to support that activity. It follows the Contraction and Convergence model for a decline in CO2 emissions and a fair sharing of these emissions between countries.

Although the 'summit' will be exactly that - our exalted leaders meeting like so many Old Testament prophets on the mountain top - we should make our demands clear. The agreement should be for a steady-state economy that balances the interests of the people of the world, and the planet we all depend on.

[Thanks to Polyp for another brilliant cartoon. Visit his website and check out his great new animated version of the rats in the trap] Tweet

But is it the right thing to do, to fuel capitalism's addiction to money? Isn't Gordon rather acting as a drug dealer, providing more of just what is worst for the global economy, bloated with years of excess and destroying the body it depends on?

But is it the right thing to do, to fuel capitalism's addiction to money? Isn't Gordon rather acting as a drug dealer, providing more of just what is worst for the global economy, bloated with years of excess and destroying the body it depends on?If you will indulge my extended metaphor for a while longer, perhaps we could explore what mechanisms we might pursue to tackle the addiction, to move the economy away from its moneylust and towards a balanced steady state. What would be the methadone that we could introduce as a substitute during the transition?

Gordon is calling for a summit to debate a new financial architecture. Part of that might be Richard Douthwaite's Ebcu or environment-backed currency unit. This is a neutral currency created by agreement between the world's nations and under their control. It could contribute to a global economy where the economic power of countries was more equal; in a world dominated by the dollar this can never be the case.

But more importantly, because the ebcu is linked to emissions of carbon dioxide, it operates like a carbon standard, linking economic activity to the ability of the planet to support that activity. It follows the Contraction and Convergence model for a decline in CO2 emissions and a fair sharing of these emissions between countries.

Although the 'summit' will be exactly that - our exalted leaders meeting like so many Old Testament prophets on the mountain top - we should make our demands clear. The agreement should be for a steady-state economy that balances the interests of the people of the world, and the planet we all depend on.

[Thanks to Polyp for another brilliant cartoon. Visit his website and check out his great new animated version of the rats in the trap] Tweet

Subscribe to:

Posts (Atom)